Weekly Update – October 8, 2018

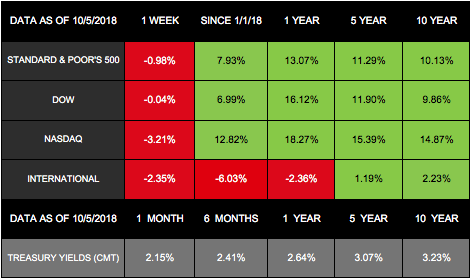

Although new data continued to show strength in the U.S. economy, markets stumbled across the globe last week. [1] The S&P 500 lost 0.98%, the Dow dropped 0.04%, and the NASDAQ declined 3.21%. [2]International stocks in the MSCI EAFE struggled, posting a 2.35% loss. [3]

While U.S. and international stocks followed similar paths last week, data is beginning to show that our economic outlooks may be very different for the moment. [4]

U.S. Strength in a Growing International Divide

The latest labor report helped underscore some of the differences between the U.S. economy and the rest of the world. While the data missed the mark for new jobs added, September marked the 96th-straight month of job growth – and the lowest unemployment level since 1969. [5] The report pushed interest rates higher, which contributed to last week’s equity losses. [6]

However, when describing our economy, Federal Reserve Chair Jerome Powell said it is experiencing “a particularly bright moment.” [7]

Global Growth Adjustments

At the same time, the International Monetary Fund (IMF) indicated that it would decrease its global economic growth predictions. The IMF hasn’t downgraded its forecasts since 2016. Currently, more risks are beginning to emerge – from trade tension to political challenges in Europe. [8] In particular, the rise in oil prices, the U.S dollar, and interest rates are hurting emerging economies. [9]

HSBC mirrored this divide, cutting its global economic outlook while upgrading U.S. numbers. [10]

A Look Ahead While Looking Back

As the labor market tightens, inflation could rise – bringing even more interest rate hikes from the Federal Reserve. [11] While rising rates bring their own set of risks, they are ultimately a sign that the economy is growing. On the other hand, when the Fed lowers rates, they do so because the economy is slowing.[12]

This week, we mark the 11th anniversary of the markets hitting their highest pre-recession point on October 9, 2007. [13] At that time, hopes that the Fed would lower rates again contributed to the new record highs. [14] In the ensuing months, the Dow lost more than half its value as the Great Recession began.[15]

While markets were down last week, they were still far ahead of their highs from 2007. The Dow closed at 14,164.43 on October 9, 2007 – and ended at 26,447.05 on October 5, 2018. [16]

Investors have experienced quite a ride in the past 11 years, but the market’s long-term growth is undeniable. Risks are here, as they always are. But we are here to help you understand and navigate those risks, no matter what the markets bring.

ECONOMIC CALENDAR

Monday: U.S. Holiday: Columbus Day

Wednesday: PPI-FD

Thursday: CPI, Jobless Claims

Friday: Import and Export Prices, Consumer Sentiment

Notes: All index returns (except S&P 500) exclude reinvested dividends, and the 5-year and 10-year returns are annualized. The total returns for the S&P 500 assume reinvestment of dividends on the last day of the month. This may account for differences between the index returns published on

Morningstar.com and the index returns published elsewhere. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

“My old father used to have a saying: If you make a bad bargain, hug it all the tighter.”

– Abraham Lincoln

Salmon BLT

Serves 4

Ingredients:

- 8 bacon slices

- ½ cup low-fat Greek yogurt

- ½ cup fresh dill, roughly chopped

- 1 scallion, finely chopped

- 1 pound skinless salmon fillet

- Salt

- Pepper

- 1 teaspoon oil

- 8 thick slices toasted bread

- Lettuce

- Tomato

- Cook the bacon until it is crisp.

- Mix together low-fat Greek yogurt, fresh dill, scallion, and ¼ teaspoon of both salt and pepper.

- Slice salmon fillet into 4 thin pieces. Sprinkle with ¼ teaspoon of both salt and pepper.

- Cook the salmon in oil on medium heat until it is opaque, 1-2 minutes per side.

- Spread the yogurt mix on 4 slices of the toasted bread. Place lettuce, sliced tomato, salmon, and bacon on top. Place 4 more slices of toasted bread on top.

Recipe adapted from Good Housekeeping [17]

How Do You Get Out of a Steep Bunker?

It’s not just your normal course hazard. It’s a bunker, with high walls and often filled with sand.

If your ball lands in a bunker, you’re faced with a dilemma: How do you get the ball to hop over the bunker barrier to go at least in the general direction of the hole?

- Calm down. You can do it. This fate has befallen other players as well.

- Analyze your predicament. Come up with an action plan. You can try to hit the ball high and hard so that it hops gently over the ledge in the direction of the hole. Or you can opt for a lower exit that might produce a cleaner break.

- Be realistic. If your ball lies against a steep face over which you must knock the ball to get it going in the direction of the hole, then choosing another escape might be the best and more reasonable option.

- If you do think you can get it to hop over the high wall, go for the long, slow swing. That means your backswing is going to stretch long to create a swing-through. Your clubhead speed will feel slower, which will produce a higher, softer shot, sending the ball hopping merrily upward and over the barrier.

- Hold the club with the left wrist (for right-handed players) cupped, which means the back of your hand is closer to the top of your forearm than your palm.

- As you swing (long and slow) release the clubhead as it moves through the sand so that you don’t dig deep into the terrain with the club’s handle leaning toward the target at the strike.

- Climb triumphantly out of the bunker. At this point, you may perform a brief celebratory dance of victory.

Tip adapted from GolfDigest[19]

Green Tips for Eco-Friendly Renovating

You’ve always been focused on environmental matters. You want everything you do to be eco-friendly. And now you want to do some home renovations. How do you renovate and remain earth friendly?

Here are six tips:

- Reconsider adding space. More room doesn’t necessarily make for more comfortable living. But it does add to utility and furniture costs.

- Do an energy audit. Hire a professional to inspect your home for efficiency.

- Hire a LEED-certified contractor. LEED (Leadership in Energy and Environmental Design) certification helps you get the latest in green building practices.

- Go with non-toxic paints. Low-VOC (volatile organic compounds) and Green Seal certified paints don’t use the more dangerous solvents.

- Get energy-efficient appliances. The “Energy Star” label on dishwashers and refrigerators directs you to the best and most eco-friendly choices.

- Donate extra materials to local organizations, such as parks and recreation departments, schools, or other community organizations.

Tip adapted from EarthShare [21]

Zack Alkhamis, CRPC, CFS

Matthew Jarrell, CFS, AIF

Timothy A. McAfee, CPA, CFP, PPC, MST

The Retirement Wealth Management Group

7900 Kirkland Court

Portage, MI 49024

269-978-0238

Copyright © 2018. All Rights Reserved.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] www.reuters.com/article/us-global-markets/stocks-fall-globally-after-u-s-jobs-data-treasury-yields-rise-again-idUSKCN1MF04H

[2] http://performance.morningstar.com/Performance/index-c/performance-return.action?t=SPX®ion=usa&culture=en-US

http://performance.morningstar.com/Performance/index-c/performance-return.action?t=!DJI®ion=usa&culture=en-US

http://performance.morningstar.com/Performance/index-c/performance-return.action?t=@CCO

[3] www.msci.com/end-of-day-data-search

[4] www.bloomberg.com/news/articles/2018-10-05/u-s-economy-isn-t-bright-enough-to-offset-global-growth-slowing?srnd=markets-vp

[5] www.cnbc.com/2018/10/05/us-markets-jobs-report-and-rates-in-focus.html

www.nytimes.com/2018/10/05/business/economy/jobs-report.html

[6] www.cnbc.com/2018/10/05/us-markets-jobs-report-and-rates-in-focus.html

[7] www.bloomberg.com/news/articles/2018-10-05/u-s-economy-isn-t-bright-enough-to-offset-global-growth-slowing?srnd=markets-vp

[8] www.bloomberg.com/news/articles/2018-10-05/u-s-economy-isn-t-bright-enough-to-offset-global-growth-slowing?srnd=markets-vp

[9] www.reuters.com/article/us-global-markets/stocks-fall-globally-after-u-s-jobs-data-treasury-yields-rise-again-idUSKCN1MF04H

[10] www.bloomberg.com/news/articles/2018-10-05/u-s-economy-isn-t-bright-enough-to-offset-global-growth-slowing?srnd=markets-vp

[11] www.bloomberg.com/news/articles/2018-10-05/u-s-economy-isn-t-bright-enough-to-offset-global-growth-slowing?srnd=markets-vp

[12] www.investopedia.com/investing/how-interest-rates-affect-stock-market/

[13] www.thebalance.com/stock-market-crash-of-2008-3305535

[14] money.cnn.com/2007/10/09/markets/markets_0500/index.htm?postversion=2007100917

[15] www.thebalance.com/stock-market-crash-of-2008-3305535

[16] www.thebalance.com/stock-market-crash-of-2008-3305535

www.cnbc.com/2018/10/05/us-markets-jobs-report-and-rates-in-focus.html

[17] www.goodhousekeeping.com/food-recipes/easy/a22566380/salmon-blt-recipe/

[18] www.irs.gov/newsroom/irs-tells-taxpayers-who-got-a-big-refund-to-do-a-paycheck-checkup

[19] www.golfdigest.com/story/your-new-plan-for-escaping-high-lipped-bunkers

[20] www.webmd.com/allergies/allergy-basics

[21] www.earthshare.org/eight-eco-friendly-renovation-tips/